具体描述

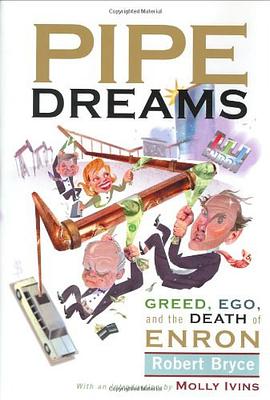

Enron. The word has become synonymous with excess, avarice, and Wall Street skullduggery. It wasn't always so. Once upon a time, Enron was a stable, profitable company with some of the best energy assets in the world. But in the late 1990s, the company changed.

Surely you've heard about some of Enron's convoluted deals and nefarious accounting practices. But what hasn't been explained is Why? Why did this once-thriving, innovative company with rock-solid cash flow suddenly implode? The answer, Texas business journalist Robert Bryce reveals in this book, is that bad business practices begin with human beings.

Pipe Dreams is not your typical boring business book. It's a gossipy, funny, irreverent analysis of Why Enron Failed. It traces Enron's transformation from a small regional gas pipeline company into an energy Goliath...and then tracks step-by-step, business decision by business decision, extra-marital affair by extra-marital affair, how Enron's leaders were corrupted. Based on interviews with more than 200 current and former Enron employees, as well as Wall Street analysts and dozens of company filings with the Securities and Exchange Commission, Pipe Dreams tells the inside story of the greed, sex, and excess that strangled the seventh-largest corporation in America. It contains profiles of the company's key miscreants, including Ken Lay, Jeff Skilling, Andrew Fastow, and Lou Pai, the secretive trading whiz who sold more stock - $270 million worth - than any Enron executive. There's also a devastating profile of Rebecca Mark, a largely-ignored player in the Enron saga, whose bad deals in India and the water business cost investors $2 billion.

After the shocking collapse of Enron in fall, 2001 came an equally shocking series of disclosures about how America's seventh-largest company had destroyed itself. There were unethical deals, offshore accounts, and accounting irregularities. There were Wall Street analysts who seemed to have been asleep on the job. There were the lies top executives told so that they could line their own pockets while workers and shareholders lost billions. But after all these disclosures, the question remains: Why? Why did a thriving, innovative company with rock-solid cash flow and reliable earnings suddenly flame out in a maelstrom of corruption, fraud and skulduggery? The answer, Texas business journalist Robert Bryce reveals in this incisive and entertaining book, is that bad business practices begin with human beings. Pipe Dreams traces Enron's astounding transformation from a small regional gas pipeline company into an energy Goliathand then tracks step-by-step, business decision by business decision, extra-marital affair by extra-marital affair, how, when and why the culture of Enron began to go rotten, and who was responsible. The story of Enron's fall isn't just a story about accounting procedures; it's a story about people. Bryce tells that story with all the personality, passion, humor, and inside dope you'd hope for, and the result is an un-putdownable read in the tradition of Barbarians at the Gate and The Predators' Ball.

From Publishers Weekly

Finally, an Enron book that actually explains what happened at Enron. Bryce, an Austin, Tex., journalist familiar with the energy and telecommunications industries, offers a colorful account of the most spectacular corporate self-destruction in American history. Tracing the company's history, he shows how deal-focused executives like CEO Jeff Skilling transformed a fiscally responsible energy supplier into an out-of-control trading firm. He describes risky practices, like "mark-to-market" accounting and shell corporations, in clear, concise language that doesn't confuse readers who don't have MBAs. The book relies heavily on good ol' boy colloquialisms (e.g., "If [George W.] Bush had been any more simpatico to Enron, he could've been charged with a misdemeanor under the state of Texas' buggery laws") but backs up every unusual assertion, revealing, for example, connections between Bush and Enron going back to the mid-1980s. Not that Democrats were innocent; there's also extensive coverage on what Enron got from government agencies during the Clinton administration. While the emphasis on sexual misconduct among the top brass and its correlation to the financial shenanigans is arguable, Bryce makes a reasonable case for former chairman Ken Lay's unwillingness to control his staff's behavior-and inability to lead by example. This isn't just the first book to make sense out of the debacle; it's a vivid cautionary tale about the consequences of the lurid excesses-personal and professional-of the recently ended economic bubble, where corporations and their employees were so obsessed with acquiring wealth they became "dumber than a box of hammers" about making-and saving-money.

From Booklist

The first Enron expose (The Anatomy of Greed, by Brian Cruver [BKL UF Ag 02]) was a view from the inside by a former Enron employee with a focus on the final months leading to Enron's demise. This one is a comprehensive piece of investigative journalism that gives a much larger overview of the energy industry, the history of Houston, and the complete story of how a medium-sized gas pipeline company became an international energy developer and trader in the complex world of energy derivatives. Along the way, Austin Chronicle reporter Bryce reveals the political history of "The Crooked E" with its ties to the Bush family and Senator Phil Gramm, who, without shame, sponsored legislation that directly benefited Enron and allowed the company to conceal its debts. All of the high-level players at Enron are profiled, and you get an excellent sense of their personalities and plenty of gossip about the sexual infidelities that ran rampant with this group of executives. Most importantly, Bryce unveils the intricate accounting schemes that allowed Enron to switch from a healthy cash flow business into one that put all its emphasis on trading revenues while ignoring the massive expenses that would ultimately pull the company into bankruptcy. Bryce's account is a prime example of how greed, arrogance, and influence lead to corruption, deception, and ruin.

David Siegfried

Book Dimension

Height (mm) 245 Width (mm) 167

作者简介

目录信息

读后感

评分

评分

评分

评分

用户评价

坦白说,在打开《Pipe Dreams》之前,我对其抱持着一种略带怀疑的态度,毕竟“史诗感”这个词在现代文学中常常被滥用。然而,这本书的“史诗感”并非来自于宏大的战争场面或王室秘辛,而是源于对个体生命中那些深刻的、无声的斗争的细致描摹。作者成功地将一个相对私密的故事,拓展出了普遍的人类困境。我感受到了那种渗透在字里行间的疏离感和渴望连接的矛盾心理。书中某个关于“传承”的段落给我留下了极其深刻的印象,它不是关于物质的交付,而是关于某种精神负担的传递,这种沉重感通过极为克制的情感表达传递了出来,效果却比任何激烈的控诉都来得震撼。作者对场景氛围的营造是一绝,他似乎有一种魔力,能将一个寻常的室内空间,瞬间转化为一个充满象征意义的心理剧场。阅读这本书的过程,就像是经历了一场细致入微的心理测绘,你随着人物的视角,深入到他们信念体系的最底层,审视那些支撑他们继续前行的信念,即使这些信念本身可能摇摇欲坠。这是一部需要耐心,但绝对值得投入精力的作品,它给予读者的回报,远超阅读本身所花费的时间。

评分这本《Pipe Dreams》绝对是近期阅读体验中一股清流,完全出乎我的意料。起初被书名吸引,带着一丝对某种不切实际幻想的期待翻开,结果发现它远比我想象的要扎实和深刻。作者的叙事功力令人惊叹,他构建的世界观如同精密的钟表,每一个齿轮——无论是宏大的历史背景还是微小的人物内心挣扎——都咬合得天衣无缝。我尤其欣赏他对时间流逝的处理方式,那种缓慢而不可逆转的宿命感,让你在阅读过程中既感到紧张,又有一种近乎冥想的平静。书中对某个特定社群的描绘尤其细腻,那种只有身处其中才能体会到的微妙的权力结构和无声的约定俗成,被作者用近乎人类学的笔触一一剖开,既不煽情,也不猎奇,只是冷静地呈现,却足以让人深思良久。书中的对话简直是教科书级别的,那些看似平淡的交流背后,暗流涌动着巨大的信息量和复杂的情感纠葛,我常常需要停下来,回味某一句看似不经意的台词,咂摸其中的深意。阅读的过程就像是在攀登一座被迷雾笼罩的山峰,每当你以为已经触及真相时,作者又巧妙地设置了新的转折点,让你不得不重新审视一切的假设。最终,合上书页时,留下的是一种久久不能散去的回味,关于选择、关于代价,以及关于那些我们宁愿相信却难以触及的“梦想”本身的重量。

评分我通常对那些篇幅庞大、信息密度极高的作品抱持警惕,但《Pipe Dreams》成功地突破了我的防线。它的体量是可观的,但阅读过程却出乎意料地流畅,这完全归功于作者对语言的精炼把控。他的文字像是经过了无数次打磨的钻石,每一个词语都镶嵌在最恰当的位置上,既有精准的描述力,又不失诗意的张力。与许多当代小说不同,这本书几乎没有出现任何为了炫技而存在的冗余段落;每一个场景,无论看似多么微不足道,都像是一根精巧的引线,最终会汇集到故事的某个关键引爆点上。我特别赞赏作者在处理“道德模糊地带”时的克制。书中没有简单地划分好坏,而是将人物置于一个进退维谷的境地,让他们在没有“正确选项”的情况下做出选择。这种对人性的复杂性的接纳,让整个故事的张力持续保持在高位,让人手不释卷,想要知道他们最终会为自己的选择付出何种代价。读完之后,我有一种强烈的冲动,想要去和同样读过此书的人深入探讨那些尚未解决的矛盾,因为它无疑是一本能够引发持久讨论的佳作。

评分要用简单的几句话来概括《Pipe Dreams》的阅读感受,简直是一种亵渎。这本书的节奏感极其独特,它像一部精心剪辑的电影,时而急速推进,将你抛入一片混乱的高潮,时而又戛然而止,留给读者漫长而沉静的空白,让你有足够的时间去消化刚才发生的一切。我特别着迷于作者如何利用非线性叙事来解构“记忆”这一主题。那些闪回和预示,不是为了制造廉价的悬念,而是为了揭示“现在”的每一个行动是如何被过去的幽灵所塑造和牵引的。它迫使你去思考,我们所珍视的现实,究竟有多少是坚固的基石,又有多少是精心编织的自我欺骗?书中对一个具体地点的执念,那种将地理空间符号化的手法,让我联想到了地理决定论的一些经典论述,但作者将其赋予了更具个人色彩的情感重量,使得那个地方不再是一个简单的背景,而是一个活生生的、拥有自己意志的“角色”。这本书的耐读性极高,初读是一次情感的冲刷,再读则是一次智力的探索,每一次深入都能发现新的纹理和隐藏的线索。它不迎合大众,但它忠诚于故事本身,这种匠人精神在当下的出版界实在难能可贵。

评分我必须承认,我对某些当代文学作品常常感到审美疲劳,那种刻意追求的晦涩和故作高深的腔调总让人难以亲近。然而,《Pipe Dreams》却以一种近乎粗粝的真诚,在复杂性与可读性之间找到了一个绝妙的平衡点。它的结构是松散的,却又在松散中蕴含着内在的逻辑,有点像一幅用破碎的镜子拼贴出的马赛克,每一块碎片都闪耀着独立的光芒,但当你退后一步时,完整的图景便豁然开朗。作者对于环境的描摹达到了近乎触觉的程度,你能真切地感受到文字中那些灰尘的味道,皮肤上拂过的风的温度,甚至能听见远处传来的那种特有的、令人不安的寂静。书中对几个核心人物的刻画,更是达到了“令人心痛”的程度,他们不是完美的英雄或绝对的恶棍,而是充满了内在矛盾的个体,他们的每一次挣扎和妥协都显得如此真实,仿佛是我们自己过去的影子。这种真实感使得阅读体验变得具有侵入性,你不仅仅是在观察故事,更像是被强行拉入了那个世界,分享着他们的呼吸和痛苦。对我来说,这本书更像是一次漫长的、私密的对话,是与作者之间,也是与自己内心深处那些从未被认真审视过的信念的交锋。它没有提供简单的答案,反而提出了更多尖锐的问题,这种挑战性正是其魅力所在。

评分 评分 评分 评分 评分相关图书

本站所有内容均为互联网搜索引擎提供的公开搜索信息,本站不存储任何数据与内容,任何内容与数据均与本站无关,如有需要请联系相关搜索引擎包括但不限于百度,google,bing,sogou 等

© 2026 book.wenda123.org All Rights Reserved. 图书目录大全 版权所有