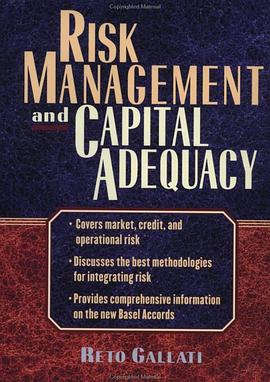

Risk Management and Capital Adequacy pdf epub mobi txt 電子書 下載2025

- FRM.09.Core.Readings

- FRM

- 風險管理

- 資本充足率

- 金融風險

- 銀行監管

- 巴塞爾協議

- 金融工程

- 信用風險

- 市場風險

- 操作風險

- 金融穩定

具體描述

This book presents a step-by-step approach for integrating market, credit, and operational risk management. While complying with New Basel Accord Guidelines for financial institutions around the world, the work involved in managing market, credit, and operational risk exposures - as well as the capital required to support such exposures - will change dramatically under the new Basel Accord guidelines. "Risk Management and Capital Adequacy" is the first book to examine how institutions can streamline programs by, wherever possible, integrating and simplifying risk management strategies and techniques.From analyses of the latest models and frameworks to case studies and examples of the devastating effects of unfocused or insufficient risk management, this in-depth examination reveals: building blocks for constructing an integrated, effective risk management framework; the three pillars of the Basel Accord - and what institutions must do to comply with each; and details behind financial disasters, from LTCM to Barings, and how they could have been prevented. While banks have an institutional interest in managing risk exposures, they also have a competitive interest in minimizing the capital required to offset those exposures. "Risk Management and Capital Adequacy" is the first book to outline an integrative framework for managing risks, and complying with the Basel Accord requirements, in the most cost-effective, capital-efficient, and competitively sound possible ways.The effective management of risk is a front-and-center topic for financial institutions. Charged with meeting everything from the newly fluid realities of global markets to the inflexible requirements of the Basel Accords, institutions are finding they must replace formalized and normative approaches with new types of risk management. These programs must be detailed enough to address the risks of today's dynamic markets yet adaptable enough to meet the needs of individual institutions and their requirements - while at the same time allowing decision-makers to demonstrate their willingness and capability to effectively handle unseen risk and increase shareholder value." Risk Management and Capital Adequacy" examines and explains today's key approaches for understanding and managing market, credit, and operational risk. The first book to provide practitioners with straightforward and hands-on techniques for integrating key risk management approaches, this all-inclusive resource covers topics such as: the history of modern risk management; regulatory mechanisms for managing risk; conceptual approaches for modeling market, credit, and operational risk; modern portfolio theory and the capital asset pricing model; uses and limitations of Value at Risk; the BIS risk-based capital requirement framework; KMV's credit monitor model; differences in credit versus market risk models; KPMG's Loan Analysis System and other risk-neutral valuation approaches; products with inherent credit risks; and, capital adequacy issues from regulatory and industry perspectives.It also includes Basel Committee on Banking Supervision and the New Basel Capital Accord Case studies of Metallgesellschaft, Sumitomo, LTCM, and Barings. Under the new Basel guidelines, all financial institutions subject to local banking laws will be required to adopt and operate under dramatically different risk exposure rules and guidelines. "Risk Management and Capital Adequacy" provides banking executives with an integrated risk management framework that is as seamless to implement as it is self-explanatory and complete. It is today's most across-the-board examination of where risk management stands today, which rules and guidelines are likely to change in the future, and how institutions can establish programs that meet risk management imperatives, limit risk capital requirements, and provide for the integration of risk management to cover the global spectrum of today's financial arena.

作者簡介

目錄資訊

讀後感

評分

評分

評分

評分

用戶評價

相關圖書

本站所有內容均為互聯網搜索引擎提供的公開搜索信息,本站不存儲任何數據與內容,任何內容與數據均與本站無關,如有需要請聯繫相關搜索引擎包括但不限於百度,google,bing,sogou 等

© 2025 qciss.net All Rights Reserved. 小哈圖書下載中心 版权所有