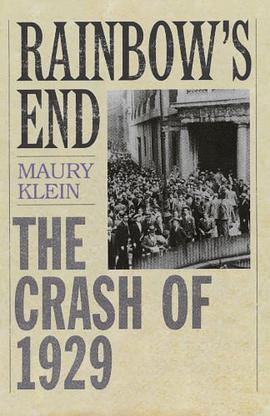

Few single events have affected business and society in the US so profoundly, and in such a short time. There have also been few books that address both these elements of the crash together, and very little published on the subject in the past decade. In this book, a gifted narrative historian with extensive background in the history of business and finance will put into perspective the many conflicting theories of what caused the crash, what role speculation did or did not play, whether or not it could have been avoided, and what role it played in bringing on the depression. The crash itself will be the climax of the narrative. Most of the book will concentrate on the decade before the crash, outlining the heavy bull market, and describing an era of unprecedented technological development, optimism, and expanding wealth. This decade saw the burgeoning of mass society and a popular culture driven by media and advertising, and a heady free market marked by unregulated banking and credit systems, and get-rich-quick schemes. Klein argues that the stock market crash marked a turning point in American history where the failure of self-regulating individualism led to an overhaul of the financial system and much more government regulation. It threw into question the beliefs in the American dream spawned by the 20s and preceded a preiod of deep depression, not only economically, but in regard to the most fundamental American values. The narrative will use a variety of people, developments, and events to illuminate these themes: Jack Morgan, Richard Whitney, Joseph Kennedy, Charles Mitchell, Herbert Hoover, John J. Raskob, and Alexander J. Noyes.

具体描述

读后感

评分

评分

评分

评分

用户评价

相关图书

本站所有内容均为互联网搜索引擎提供的公开搜索信息,本站不存储任何数据与内容,任何内容与数据均与本站无关,如有需要请联系相关搜索引擎包括但不限于百度,google,bing,sogou 等

© 2025 book.wenda123.org All Rights Reserved. 图书目录大全 版权所有