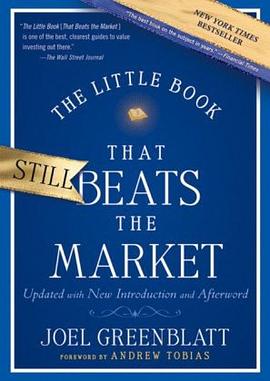

The Little Book That Still Beats the Market pdf epub mobi txt 电子书 下载 2026

- 投资

- 金融

- 价值投资

- investment

- 股票

- 英文原版

- 长期投资

- 投资理财

- 投资

- 股票

- 市场

- 策略

- 基本面

- 量化

- 经典

- 实用

- 金融

- 趋势

具体描述

In 2005, Joel Greenblatt published a book that is already considered one of the classics of finance literature. In The Little Book that Beats the Market—a New York Times bestseller with 300,000 copies in print—Greenblatt explained how investors can outperform the popular market averages by simply and systematically applying a formula that seeks out good businesses when they are available at bargain prices. Now, with a new Introduction and Afterword for 2010, The Little Book that Still Beats the Market updates and expands upon the research findings from the original book. Included are data and analysis covering the recent financial crisis and model performance through the end of 2009. In a straightforward and accessible style, the book explores the basic principles of successful stock market investing and then reveals the author’s time–tested formula that makes buying above average companies at below average prices automatic. Though the formula has been extensively tested and is a breakthrough in the academic and professional world, Greenblatt explains it using 6th grade math, plain language and humor. He shows how to use his method to beat both the market and professional managers by a wide margin. You’ll also learn why success eludes almost all individual and professional investors, and why the formula will continue to work even after everyone “knows” it. While the formula may be simple, understanding why the formula works is the true key to success for investors. The book will take readers on a step–by–step journey so that they can learn the principles of value investing in a way that will provide them with a long term strategy that they can understand and stick with through both good and bad periods for the stock market. As the Wall Street Journal stated about the original edition, “Mr. Greenblatt…says his goal was to provide advice that, while sophisticated, could be understood and followed by his five children, ages 6 to 15. They are in luck. His ‘Little Book’ is one of the best, clearest guides to value investing out there.”

作者简介

乔尔·格林布拉特是Gotham资本公司的创始人和合伙经理人,自1985年这一私人投资公司成立以来,它的年均回报率达到了40%。他不仅是哥伦比亚大学商学院的客座教授,一家《财富》500强公司的前董事长,价值投资者俱乐部网站(ValueInvestorsClub.com)的合作发起人,还是《你能成为股市天才》一书的作者。格林布拉特拥有理学学士学位,并从沃顿学院获得工商管理硕士学位。

目录信息

读后感

这本小书在华尔街影响很大,《憨夺型投资者》的作者,〈Enhancing Trader Performance〉和〈重塑证券交易心理〉的作者在他们的书中都引用过这本书。 其作者Joel Greenblatt于1999年出版过一本《You Can Be a Stock Market Genius》,没有出过中文版。最近《Value》杂志社...

评分用低的价格购买好的公司,赚自己看的见得钱,不为错过暴涨的机会而惋惜。虽然很多废话,但真能做到考的不是智商是情商。

评分 评分第一版为2007年,第二版为2010年,老外的版是2006年的。翻译人员没变。价格07版18元,10版24元。我发现的就这些了。这本书我是今年3月在当当上买到的第一版的。价格便宜,我觉得足够了;对于不到200页的小册子来说,这本书就是一种理念,其他的全在语言幽默易懂上,但是语言的...

评分投资的方法就是: 选择高资产回报率以及低市盈率的股票,坚持长期投资,做一个20~30只股票的投资组合。 内容简单了点,适合初读股票书的人;当然操作起来还是有点困难,如果有按上述3句话操作的基金,就不需自己操作股票,直接买入该基金就可以了。

用户评价

读完《The Little Book That Still Beats the Market》后,我感觉自己像是获得了一张隐藏在平凡股市迷雾中的宝藏地图。这本书并没有像许多投资指南那样,充斥着复杂的技术分析术语和令人眼花缭乱的图表,反而以一种极其平实、易懂的方式,娓娓道来一个关于“好公司”和“好价格”的简单投资哲学。作者 Joel Greenblatt 并没有试图教我们如何预测市场,而是巧妙地引导我们关注那些真正构成一家优秀企业的要素,以及在何种时机以何种价格买入它们。书中反复强调的“神奇公式”概念,虽然听起来可能有些简化,但它背后所蕴含的深刻洞察,却足以颠覆许多投资者固有的思维模式。我尤其欣赏作者在解释这个公式时所使用的比喻和案例,它们生动形象,让那些原本可能枯燥的财务指标变得触手可及。我发现自己开始重新审视那些被市场忽视但业绩稳定的公司,不再盲目追逐那些涨势凶猛但根基不稳的股票。这本书的价值在于它提供了一个清晰、可行、且长期有效的投资框架,帮助普通投资者摆脱情绪的干扰,回归理性的价值投资。

评分《The Little Book That Still Beats the Market》这本书带给我的,是一种久违的清醒和信心。在如今这个信息爆炸、市场波动剧烈的时代,许多人都在追求短期内的收益,或者被市场的喧嚣所裹挟,很容易做出冲动的决定。这本书就像一股清流,提醒我们要回归价值投资的本质。它并没有复杂难懂的金融模型,也没有预测市场走势的“黑科技”,而是用最朴素的逻辑,教我们如何找到那些真正具有长期投资价值的公司。我尤其喜欢作者在解释“好公司”和“好价格”时所用的例子,它们非常接地气,让我这个非金融专业人士也能理解。读完这本书,我不再害怕市场的短期波动,因为我知道,只要我坚持以价值为导向,找到那些质地优良且价格合理的股票,长远来看,市场终将给予回报。这本书不是一本教你如何“玩转”股市的书,而是一本教你如何“正确地”进行投资的书,它让我们从被动的市场参与者,转变为主动的价值投资者。

评分《The Little Book That Still Beats the Market》这本书,对我来说,与其说是一本投资指南,不如说是一次思维的启蒙。我之前对股票投资一直持有一种敬而远之的态度,觉得那是专业人士的游戏。但这本书用一种非常易于理解的方式,向我展示了价值投资的魅力。作者并没有沉迷于复杂的金融术语,而是用最直白的语言,阐述了如何去发现那些被低估的优秀企业。我尤其赞赏书中关于“神奇公式”的解释,它虽然简洁,却能帮助我们快速筛选出那些具备良好盈利能力和合理估值的股票。读完这本书,我不再盲目地追逐市场上的“热点”,而是开始关注那些有长期增长潜力的公司。它让我意识到,投资的关键在于耐心和理性,在于寻找那些真正能创造价值的企业。这本书就像一位睿智的长者,用朴实无华的语言,为我指点迷津,让我看到了投资的另一种可能性,一种更踏实、更长远的投资道路。

评分说实话,拿到《The Little Book That Still Beats the Market》这本书的时候,我并没有抱太高的期望。市面上关于股票投资的书籍太多了,很多都让人读了之后感觉像是被灌输了一堆高深的理论,却不知道该如何实际操作。然而,这本书却给了我一个惊喜。它不是那种让你一夜暴富的秘籍,也不是让你成为华尔街精英的速成手册,而是一本真正能够帮助你理解“好公司”到底意味着什么的启蒙读物。作者以一种非常“亲民”的方式,剖析了那些被低估的优秀企业,以及它们为何会在市场上“睡着”。我之前总以为投资股票就是看K线图、看新闻,然后凭感觉下单,但这本书让我明白,真正的投资在于对公司内在价值的深入理解。它提供了一种简单却有效的策略,让我们能够识别那些具备持续盈利能力,并且价格合理的股票。我试着按照书中的一些思路去观察一些我熟悉的行业,竟然发现了一些我之前从未注意到的投资机会。这本书就像一个灯塔,在我迷茫的投资之路上指引方向,让我看到了不同于以往的投资可能性。

评分这本书最让我印象深刻的地方,在于它打破了我之前对投资的许多固有认知。我一直觉得投资股票是一件非常复杂、需要专业知识的事情,需要整天盯着盘面,分析各种数据。但《The Little Book That Still Beats the Market》这本书却用一种非常简洁明了的方式,告诉我们其实可以从更宏观的角度去看待投资。它并没有提供一种“万能”的公式,但它提供了一种思考框架,让我们能够更清晰地辨识出那些真正有潜力的公司。作者以一种轻松幽默的笔调,解释了价值投资的核心理念,让我对“好公司”和“好价格”有了更深刻的理解。我之前会因为市场的短期下跌而恐慌,但现在,我更能从长期的价值角度去评估我的持股。这本书让我意识到,投资并不一定要追逐热门的概念,有时候,那些被市场忽视的,但基本面扎实的股票,反而更值得关注。它是一本能够改变你投资观念的书,让你不再被市场牵着鼻子走。

评分入门入门读物,实战没有任何作用,仅仅如何预测几年后的normalized profit就已经让街上的分析师够忙了,一个个人投资者能做到?可能是本劝退读物吧~

评分1)Another strict investing mode that reader can not follow. 2)Comment on 2015.10, I remember it's a book using 格老's low PE/PB high ROE,dstributed investment method, it's the one that I'm now following. It's also one piece to fomalize my investemnet system. Thank you!

评分哎呀,感觉不错,不知道a股这种大波动,数据差的地方实用性如何。

评分Buy good companies at bargain price.

评分跟第一本啥區別???

相关图书

本站所有内容均为互联网搜索引擎提供的公开搜索信息,本站不存储任何数据与内容,任何内容与数据均与本站无关,如有需要请联系相关搜索引擎包括但不限于百度,google,bing,sogou 等

© 2026 book.wenda123.org All Rights Reserved. 图书目录大全 版权所有